Contents

It is not uncommon for a broker to experience difficulty in paying large sums and delays. As you can see in the order mask, you can always bet on rising or falling prices. This is easily possible with forex trading and happens during CFD trading via short sales.

In summary, we can say from my experience that the analyzes offered, etc. are very well applicable for their own trade. Beginners and advanced traders can expand and improve their knowledge for free. XM offers a free demo account of over $ 100,000 in virtual credit. This account can be used indefinitely and it is the perfect way to get practice with the broker.

This platform is specifically designed to let traders handle more than one MT4 accounts from a single terminal. If you use the trading platform outside of these hours, trades will not execute. For XM Ultra Low Accounts, the leverage is identical, but spreads can be as low as 0.6 pips. There is no leverage on Shares Accounts and the spread is per the underlying exchange. Additionally, XM remains respectful to the idea of Islamic Accounts, never using “swap-free in disguise” accounts.

🏆 10 Best Rated Forex Brokers

Meaning, instead of regular 4-digit quoting prices you can benefit from the smallest price movements by adding a 5th digit, known as a fraction. As for the account base currencies, by choosing XM Account you may select the base currency of your preference from the great supported selection. This range includes even the South African Rand or Singapore Dollar , besides to other global currencies.

The pros and cons of using the broker’s trading account have been summarized below. Bank transfers can take a few business days to clear and XM covers all the charges for bank transfers of $200 or more. Accounts can be opened in a great selection of currencies including USD, GBP, EUR, CHF, JPY, PLN, SGD, ZAR, AUD, HUF & RUB. The various different currency options are beneficial as currency conversion fees do not apply when using an account in your own currency. XM Group give you access to trade a wide range of more than 1000 financial instruments including Forex, Commodities, Stocks, Shares, Indices, Metals, Energies & CFDs. This is an excellent selection that I would put up there with some of the best in the industry.

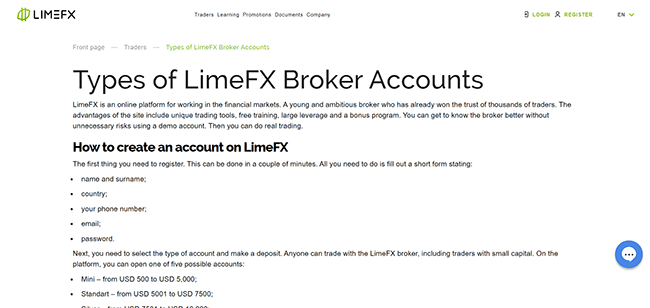

For the best trading experience, there is no substitute for the MT4/MT5 desktop trading platforms. It can be said that these levels of spreads and commissions are competitive for depositors of relatively low amounts. The minimum deposit required to open a Standard Account is only $5, so for traders depositing only a few hundred dollars or less, these fees will certainly be competitive. Finally, the XM ULTRA LOW account allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips, and has a minimum initial deposit of $50. The XM forex review breaks down the services this broker company provides, which primarily categorizes into research, training, and platforms. The company offers a list of services under its market research category.

This is a notification that your account lacks sufficient equity for supporting the open positions. For those who typically engage in telephone trading, the dealers may give a margin call. This is essentially advisement to either deposit funds or close positions. XM can also help clients create custom-tailored accounts for trading forex. XM also offers its operational philosophy as a reason to consider choosing this company as a broker.

Non-Trading Fees

XM Group is a group of regulated online brokers, which serves as Trading Point of Financial Instruments Ltd established in 2009 and regulated by the Cyprus Securities and Exchange Commission . Another entity Trading Point of Financial Instruments was established in 2015 in Australia and is regulated by Australian Securities and Investments Commission . Read more, why trade with Australian Brokers by the linkso the regulatory obligations are covered xm forex review at a sustainable level as we see through our XM Review. Please trade responsibly selecting the leverage based on your risk appetite and loss tolerance level. Some trading strategies like automated scalping may require high leverage while many professional traders do not use much leverage. PLEASEEE. IF YOU ARE A SERIOUS TRADER, DON’T TAKE THE BONUS ACCOUNT. Because there is a lot of rules that you need to obey in order to trade at XM.

XM gives clients the ability to trade more than 1,000 instruments across seven asset classes. These include forex, individual stocks, precious metals, commodities, cryptocurrencies, energies, and equity indices. To start trading with XM, an initial minimum deposit of $5 is required for Micro and Standard accounts and $50 for Ultra-Low accounts. When funding an established trading account, no minimum deposit is required, although certain e-wallet payment methods require a minimum of $5. Live Forex seminarsare scheduled seminars to meet with other traders presented by their Portfolio manager Avramis Despotis, who teaches about the financial markets. The online broker offers great market access to retail investor accounts with over 1,250 CFD trading products available to choose from.

How do I start using XM?

Now you look their ultra account, years ago min depo was 50 usd, now become 5usd. I think most newbies have tried this broker due to their heavy marketing. So far they have honored all my profit withdrawals without any problems. My only tips for this broker is DO NOT involved in any of their bonuses, schemes, IB and so forth. Finally, XM has a currency converter using live currency rates, suitable for traders who make deposits outside their account base currency.

When compared to the WebTrader and desktop platforms, mobile users face no restrictions on order types or market access. For both beginner and professional traders MT5 ensures platform features and functionalities that are in line with the highest expectations of any online investor today. Suitable for both beginner and seasoned traders with versatile investment skills and practices, MT4 can be regarded today’s ultimate trading software in virtually every spot of the globe. The release of the MetaTrader 4 platform in 2005 was a milestone for MetaQuotes and the online trading community.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. The XM Economic Calendar is a great tool for following the date and times of news releases that can impact the global financial markets. The calendar displays the previous results, forecasted result and actual impact of all news releases.

- Meaning, instead of regular 4-digit quoting prices you can benefit from the smallest price movements by adding a 5th digit, known as a fraction.

- XM forex indeed pays great care to traders’ needs and requests.

- An Islamic account is optional and the minimum deposit is $5.

- This is why management has visited more than 120 cities worldwide to meet with clients as well as partners.

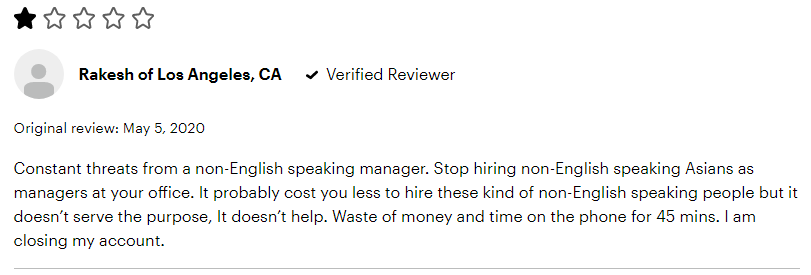

I invested 10k usd but nothing come back to me. my account manager name is joseph cohen and financial manager is kevin brown. Those people are real scammers because talking nice until get your money after if you just request some withdrawal and then you will know about them. I lost my 10k which left me heart broken until I encountered ChainVault who are experts in resolving cases like this. While XM will try to exit your open trades, slippage can still occur, meaning your account can still go below zero. This means XM will return your account back to $0 and your debt will be forgiven.

All instruments are available to trade from the same trading account on 16 trading platforms which makes your trading easier and more efficient. The broker offers an advanced trading platform as well as flexible trading conditions to accommodate a range of global clients. XM’s expertise comes from in-depth knowledge of and experience with the global financial markets. Lastly, Zero Accounts will offer you another fee strategy where the spread is an interbank quote starting from 0 pips and the trading charge will be deducted through a commission per lot, see our snapshot below. XM minimum deposit in all 3 types of accounts is only $5 which means it’s a very low rate for any trader to open an account and start live trading. You can open up to 200 trading positions in all account types.

All videos are Primary or Intermediate so anyone with a validated XM Account can access all of them. You can make use of any by contacting your Personal Account Manager. Those supplement the algorithmic trading tools already built into MT4 and MT5. At the bottom of the same page, you will find FAQs for MT4, including validating and gaining access to your account. You still get the same flexible leverage and no requotes or rejections.

Where is XM based?

In conclusion, XM is considered a well-known and established brokerage firm with global recognition with a top-notch reputation. You will be to find all of their educational resources under the tab, “Learning Center”. There are many forms of educational resources with XM; they make sure not to leave any rock unturned.

Retail clients with Standard, Micro, or XM Ultra Low Accounts have a stop-out level of 20 percent. This is further hampered by the fact that many brokers restrict trading close to news announcements. The information provided varies by asset class and can also include min and max trade size and margin percentage. All of this information is divided by account type, so you know where you stand for each specific asset.

Does XM offer the MetaTrader trading platform?

With Olymp Trade, there is an option that traders can make a withdrawal, after completing the deposit. The maximum waiting time for a withdrawal request can take up to three days, but Olymp Trade attempts to finish the transaction as fast as possible. Any trader with the Standard Account, the average waiting time is twenty four hours. However, as a VIP Account holder, the average waiting time is only a few hours. There are different types of fees that are provided for each account type. The inactivity fee is charged after ninety days, and it is relatively low, with a fee of 5USD.

XM Education ranked with overall rating 10 out of 10 based on our research. XM provides great Education Materials, quality research and runs https://forex-reviews.org/ its Academy with Webinars, Excellent Trading videos and more. As an example assume that the interest rates in Japan and the US are 0.25% p.a.

Can you trade forex at XM?

MetaQuotes made a real breakthrough by releasing the MetaTrader 5 multi-asset trading software system in 2010. The new platform allows trading Forex symbols, stock instruments and futures. MetaTrader 5 features all the latest developments the company has to offer. The new product is much faster, more functional, more reliable and more convenient than previous-generation platforms. Millions of traders from around the world gradually appreciated advantages of the new platform which lead brokers to replace the outdated platforms with MetaTrader 5. Furthermore, the XM Group support team is second to none, with 24/7 live chat available which from my experience give very accurate and prompt responses.

It delivers a new breadth of asset classes and has an economic calendar that tracks main market developments. Between MT4 and MT5, this trading platform may be intimidating for beginners due to its complex programming and advanced tools. The global market for forex and commodity trading is a complicated place to gain success. People new to the world of trading financial instruments cannot tread these waters and earn profits by themselves.