Contents:

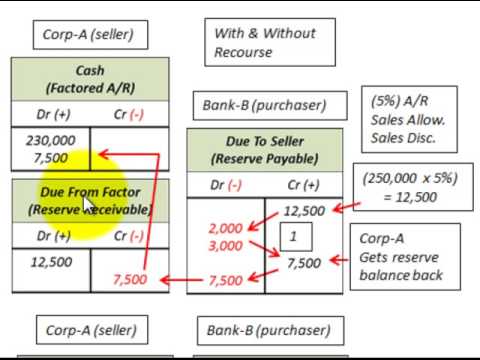

Good Deal used the chart of accounts example for one month and had recorded one month’s depreciation of $20. This means the book value of the equipment is $1,080 (the original cost of $1,100 less the $20 of accumulated depreciation). On July 1, Good Deal sells the equipment for $900 in cash and reports the resulting $180 loss on sale of equipment on its income statement. Disposal with cash proceedsUse a disposal with cash proceeds when you receive cash for disposed assets. When you specify this disposal type, the system debits the Cash/Clearing account and credits the Proceeds from Sale account.

The default version of the Post G/L Entries to Assets program posts all unposted fixed asset entries. To post only disposal entries, you must create your own version of the post program and attach it to the menu option. When an asset is disposed, it will appear on the Depreciation Journal for tax ledgers until the end of the current fiscal year. Even if no depreciation is calculated, the asset will appear on the Depreciation Journal. The asset will not appear on the Depreciation Journal for the next fiscal year once you run the Fixed Asset Annual Close. When you receive cash for an asset, you debit the cash account and credit the Cash/Clearing account.

Record the sale of the asset

This is not realistic for it is not possible to have a case where by the purchase of the non-current asset is so timely to take place on the first day of the beginning of a financial period. Again, an organization does not buy only one non-current asset at a time. On the other hand, it is not easy to dispose the non-current asset at exactly the last date of the year end. The following entry is recorded after the depreciation adjustment for the period is made. Construct the journal entry to record the disposal of property or equipment and the recognition of a gain or loss. To help you understand how to make the disposal of a fixed asset, we take an example of a company that purchases equipment for $20,000 and recognizes $1,000 of depreciation per year over the following five years during the asset’s life.

- The asset disposal definition refers to eliminating a company’s asset from accounting records, generally by selling or scrapping it.

- This loss was reported on the income statement thereby reducing net income.

- He completed a Bachelor of Science degree in Accountancy at Silliman University in Dumaguete City, Philippines.

- This Statement also amends ARB No. 51, Consolidated Financial Statements, to eliminate the exception to consolidation for a subsidiary for which control is likely to be temporary.

- This is because when land is sold, there is no accumulated depreciation expense to remove from the accounting records as land is not depreciated.

Companies acquire, dispose of, or exchange assets, or items of value that it owns. Operational assets are assets that the company uses to earn revenue, the money it earns from selling its goods and services, and are not sold to customers. Tracey has a better understanding of how to record the purchase of an asset, but she wonders how to record a purchase when a company pays one amount to acquire more than one asset, which is known as a basket purchase. We must determine a value for each asset, and this is allocated according to each asset’s fair market value, or the value that a knowledgeable buyer would pay to acquire it. Inventory on July 31 is $200 (4 calculators at a cost of $50 each).

How to record the disposal of revalued non-current asset?

In the UK, Business Asset Disposal Relief or BADR is a kind of tax relief that reduces the capital gains tax amount due after the disposal of an asset. Previously, this relief was called the ER or Entrepreneur’s Relief. Organizations need not account for the maintenance and repair costs for the asset disposed of. Subtract the accumulated depreciation from the initial cost of the asset.

- The entry to record the truck’s retirement debits accumulated depreciation‐vehicles for $80,000, debits loss on retirement of vehicles for $10,000, and credits vehicles for $90,000.

- A company may no longer need a fixed asset that it owns, or an asset may have become obsolete or inefficient.

- A company may dispose of a fixed asset by trading it in for a similar asset.

- In accordance with Section 273.05, Florida Statutes, the University has appointed a “Property Management Committee” to review all dispositions information for UF owned capital assets.

From an accounting point of view, it is then a question of noting all the changes in the assets of the company, as well as the impact on the income statement of the fixed assets’ disposal operation. Provides guidance on the accounting for a long-lived asset if the criteria for classification as held for sale are met after the balance sheet date but before issuance of the financial statements. That guidance prohibits retroactive reclassification of the asset as held for sale at the balance sheet date.

Tax & accounting community

Fixed Assets are not revalued unless there has been a significant change in value shortly before they are closed. It is unlikely that the company would sell all of its Fixed Assets before the next revaluation, if they were to be sold and there was no change in value at this point, it could result in a loss on sale of these assets. If there has been a significant change in market value shortly before the Fixed Assets account is closed and if there has not been a previous revaluation, then the fixed asset’s carrying value may be overstated. In this case, it might be better to revalue the Fixed Assets to show their new market values at the end of the period. Like all expense accounts, this debit balance should be transferred to the debit of profit and loss account at the end of the year. Motors Inc. estimated the machinery’s useful life to be three years.

This type of disposal would take place during the asset’s life and not in the year the asset is placed in service, or in the final year when an asset becomes fully depreciated. In the first and final years of an asset’s life, the First Year Spread and Last Year Spread will override the disposal rules. If your system requires batch approval, you must post the disposal journal entries manually to the general ledger before you run Post G/L Entries to Assets. You can use processing options to run a preliminary or final mass disposal. The preliminary disposal does not create disposal journal entries. Run a preliminary disposal for proofing purposes before you run the final disposal.

It would not be appropriate to reclassify only the pro rata portion of each of the subsidiary’s balance sheet line items being sold to held for sale in the reporting entity’s balance sheet. See BCG 5.5 for additional details on changes in interest resulting in loss of control. Depreciation expense is recorded for property and equipment at the end of each fiscal year and also at the time of an asset’s disposal. To record a disposal, cost and accumulated depreciation are removed. Any proceeds are recorded and the difference between the amount received and the book value is recognized as a gain or a loss . Many companies automatically record depreciation for one-half year for any period of less than a full year.

SEC to Impose Significant New Privacy and Cybersecurity Rules for … – Goodwin Procter

SEC to Impose Significant New Privacy and Cybersecurity Rules for ….

Posted: Thu, 13 Apr 2023 20:04:45 GMT [source]

Suppose a $90,000 delivery truck with a net book value of $10,000 is exchanged for a new delivery truck. The company receives a $6,000 trade‐in allowance on the old truck and pays an additional $95,000 for the new truck, so a loss on exchange of $4,000 must be recognized. Certain types of assets, particularly vehicles and large pieces of equipment, are frequently exchanged for other tangible assets. For example, an old vehicle and a negotiated amount of cash may be exchanged for a new vehicle.

When a https://1investing.in/ asset that does not have a residual value is fully depreciated, its cost equals its Accumulated Depreciation balance and its book value is zero. In these situations, the SEC staff has indicated that there are two acceptable interpretations of the literature for accounting for the loss on sale at the held-for-sale date. 7.2 Calculate and compare depreciation expense using straight-line, reducing-balance and units-of-activity methods. Disposal year rules are designed to allow an asset to calculate depreciation to meet the requirements of a disposal year convention in the year an asset has been disposed.

You’re not sure of which types of accounting records could suitable for your business or which accountant to hire? No worries, this article will gently accompany you in your knowledge journey. For example, a production tool is purchased for $10,000 and must participate in the activity of the company for a period of 10 years. Each year, the company then passes a depreciation allowance of $1,000.

A processing option has been added to prevent the user from modifying account and amount information for a disposal journal entry. Remove the original value of the asset and it’s accumulated deprecation from your balance sheet, and transfer the value to your profit and loss using a Journal. Organizations use this form to document the asset disposal process. For example, state agencies, banks, and other businesses utilize this form to monitor their assets.

That said, one must remember that individuals’ claims must not exceed £1 million over their lifetime. Also, one may be able to claim a higher amount if they offloaded their assets before March 11, 2020. As mentioned earlier, Companies can dispose of an unrequired asset by offloading it. This frees up cash and allows them to invest in multiple areas of the business. Multiply the amount of depreciation by the total years of service offered by the asset to calculate the accumulated depreciation.

The asset disposal definition refers to an accounting process organizations use to remove assets, typically long-term ones, from the accounting records by scrapping or selling. Also, if a company disposes of assets by selling with gain or loss, the gain and loss should be reported on the income statement. Capital assets are essential to successful business operations. Moreover, proper accounting of the disposal of an asset is critical to maintaining updated and clean accounting records. There are four accounts affected when writing off a fixed asset at disposal. When you write something off the books, accounts with normal debit balances are credited and accounts with normal credit balances are debited.